When you’re considering building a fintech product or Fintech app, one of the very first—and often most daunting—questions is how can you finance the app development without hurting your bank and how much does fintech app development cost?

Many entrepreneurs and startups feel overwhelmed by the financial commitment required to build a competitive fintech solution. And let’s be honest, bootstrapping a fintech app requires clear vision, dedication and conviction

The hard-hitting reality is, traditional financial services are evolving fast, and the pressure to innovate is higher than ever. So the app you are going to be building cannot be another boring banking app, or a digital wallet that crashes very often.

The pain point here is clear: without an accurate understanding of the cost to develop a fintech app, planning your budget and securing funding becomes a significant challenge.

In this guide, we will cover:

- Is fintech app development a worthy investment?

- Fintech mobile app development process and factors influencing the cost.

- The real cost of building a world-class fintech application (no-BS, straight to the point)

- Challenges in building a cost-optimized fintech application in 2025.

By the time you will be finishing this blog, you’ll have a clear understanding of the factors that influence fintech app development costs and how to plan your project effectively to spend optimally and get the ideal outcomes.

Before Looking at Costs, Let’s Get This Straight

The fintech industry, especially with fintech app development on the rise, is revolutionizing how consumers interact with money. Digital wallets or online banking apps, or even automated investment management and cryptocurrency trading apps, the surge in financial technology is making services more accessible and cost-effective.

According to Statista, the global fintech market is projected to reach over $700 billion by 2030, while Forbes notes that digital banking users in the United States are expected to surpass 200 million by the end 2025.

To most, these are mere figures. Something not very exciting.

But for visionaries like you, and many others, it is an opportunity that is ripe and ready to be pounced on. These figures make it clear that there is massive potential and growing demand for fintech solutions, driving up the need for robust, innovative apps.

Now, with that out of the way, let’s jump right in and go right to today’s subject.

Also read: Flutter App Development Cost: Full Pricing Breakdown

Get a Free Cost Estimate

Curious about your fintech app development costs? Get a personalized, no-obligation estimate today!

Hire ExpertFintech App Development Process & What Influences the Cost

There are various factors that influence fintech project app development costs. You should also know how to maintain your app or how much does it cost to maintain an app? These can be regional compliance issues, something related to the exchange tariff, or just the app development process.

But there is one thing more important out of all these: the technicalities. Here are a few important ones to understand, with how things actually work.

1. Understanding the Project Scope

Before diving into development, it’s crucial to clearly define the scope of your project. This involves identifying the core functionalities of the app, such as:

- What specific features do you need?

- What level of secure payment processing is needed?

- Is there a need for real-time data analytics to manage incoming and outgoing payments?

- Are there third-party financial affiliations mandatory, so that you know what APIs you will need?

Once you have answers to the questions above, then you have the next set of questions ready to be answered. These are:

- What are the regions in which you are going to launch your app?

- Will it be multilingual or monolingual?

- Will it have different features based on regions?

- Who is the fintech app targeted at?

- Is it the small businesses that will use the application or is it suited for individual customers, or maybe financial institutions?

Then, linked to the questions above, there will be decisions to be made related to regulatory requirements. Because as you might already know, the financial sector is the most closely monitored and scrutinized around the globe.

- Identifying Core Functionalities: What specific features do you need? Do you require secure payment processing, real-time data analytics, or integration with third-party financial services?

- Target Audience: Are you developing for individual consumers, small businesses, or large financial institutions?

- Regulatory Requirements: Fintech apps must comply with strict regulatory standards, which can add layers of complexity and cost.

Do you think all this is too much?

Well, maybe. But as a credible mobile app development company, we believe in doing whatever it needs to educate our readers on how the tech ecosystem works, in the easiest of the ways.

A precise scope not only guides your project but also helps in providing an accurate fintech development app estimate.

2. App Design and User Experience

Once the project scope is finalized and locked, and all features listed in the business requirement document and statement of work document, then comes the part where it all begins to take shape.

This is the fintech app design and user experience phase. An engaging and intuitive user interface (UI) and user experience (UX) are critical in fintech.

In a fintech mobile app, users expect:

- Ease of use, with unfaltering security which ultimately builds trust.

- Simplistic and minimal navigation, where all important data is displayed at the front and all buttons are shown clearly.

- Personalized app experiences, based on user’s own profile, that help the user become comfortable with the overall user interface.

At first, this might seem too much, maybe an overkill. But in reality, paying close attention to the finicky details on this step will help in later stages.

Investing in quality design can significantly impact the overall cost to build a fintech app as this is the foundation being laid. Getting the services of expert financial UI designers along with UX experts is important to get through without any issues.

3. Technology Stack and Integration

So now that the design is done and dusted, it is time to move to the next stage: finalizing the tech stack based on the features, and the integrations (APIs) required.

It goes without saying that the goal is to keep the fintech application as light and fast as possible, and hence that must be the consideration when finalizing the tech stack.

(nobody really wants to use slow and heavy mobile applications)

The choice of technology stack affects both the performance and cost of your fintech app, so without your mobile app consultant, take your time to understand what works best in your unique case.

Here’s a holistic overview of the tech stack that needs to be decided.

- Frontend development: This is where the user interacts with the application so it must look and feel good, from buttons to screen switches and everything else.

- Backend infrastructure: This is where servers and databases are built and connected, essential to handle high volumes of transactions securely.

- APIs and third-party integrations: In this phase, external services like payment gateways, market data providers, or banking APIs are required for secure and efficient workflows.

- Security protocols: Given the sensitivity of financial data and strict regulatory requirements, top-notch security measures (e.g., encryption, multi-factor authentication) are a must, majorly influencing fintech app development costs.

Each of these elements influences how much does it cost to build a fintech app and can vary based on the complexity of your requirements.

4. Development Stages and Timeline

The design is finalized and the tech stack is decided with the right talent sourced, now there is no point in waiting for development to get started. The fintech app development is among the key components that influence the overall cost of the project.

It is also usually the most time-consuming phase, where the actual fintech mobile application is developed.

The development phases for mobile apps generally vary depending on the teams and development methodologies. However, this is how it generally works in most development houses.

- Explicit goals are established – timelines for major milestones, weekly sprints, budget allocation – all this is done to avoid any delays mid-development.

- An MVP, also known as a Minimum Viable Product, is built with just the basic features to test the core functionalities of the fintech mobile app.

- More advanced features are added to the application as development progresses, ensuring smooth working of all required features.

- With all the development going on, experienced fintech app development companies focus on testing and quality assurance of the application so that the app runs smoothly, is fast and light, and serves its purpose.

- The last phase is the deployment and maintenance of the app, which involves the app launch, and providing ongoing support and rolling out updates – which is a recurring cost for a fintech app development project.

It must be noted that the longer and more complex the process, the higher the overall cost to develop a fintech app. However, there are a few baseline requirements and you cannot skip any stage to cut costs.

The real game is about managing the resources optimally, allocating them to the right process at the right time, and getting things done on time, with minimal hiccups.

5. Team Expertise and Location

If you hire a team of developers in Maldives, versus a team in the United States, who is going to cost you more?

However, the debatable bit is, is it worth spending on talent from less popular locations even if the talent is not as skilled and experienced?

Whatever your opinion is, it is clear that expertise of your development team plays a significant role in defining the cost of your overall project.

There are multiple ways you can staff a project. It can be an in-house setup, where you hunt the right talent, pick the best ones, hire them, pay them monthly and wait as your project trots towards completion.

The other way, which is more logical, is hiring an experienced mobile app development company with a comprehensive application-building portfolio. All you have to do is to sign an NDA (Non-Disclosure Agreement) with them, share your idea, get the cost assessment done, and voila, you have a fintech app development partner.

In essence, how much does fintech cost largely depends on these factors, and choosing the right team is essential for balancing cost and quality.

The Real Cost of Building a World-Class Fintech Application (A No-Nonsense Breakdown)

Developing a fintech application is a strategic investment that requires careful financial planning, regulatory foresight, and a clear understanding of market demand, and it has costs.

So, without further delay, let’s cut to the chase and learn about fintech app development costs and differences for multiple apps. Below is a detailed analysis of the financial considerations behind fintech app development.

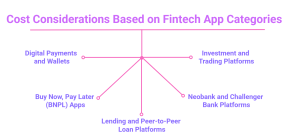

Cost Considerations Based on Fintech App Categories

The overall cost of developing a fintech application depends on the type of product being built, its complexity, and the regional regulatory outlook it operates in. Below is an estimate of development costs across different fintech sectors.

-

Digital Payments and Wallets (e.g., PayPal, Venmo, Cash App)

Digital payment apps and wallets are not new to the market. These are widely accepted around the globe and facilitate secure transactions, but need robust and solid infrastructure for seamless processing.

To build such an app, with all the usual fintech digital payment app features, the cost would be around $60,000 to $250,000 – all this depending on features and other requirements like multi-currency support, fraud detection and others to keep the user trust intact.

The key investment areas in an idea like this would be the integration of payment gateways like Stripe, PayPal, and Swift. Moreover, complying with stringent financial regulations like PCI-DSS is also a critical factor.

-

Investment and Trading Platforms (e.g., Robinhood, E*TRADE, eToro)

Apps like Robinhood and eToro are online investment and trading platforms, providing real-time access to financial markets. Through their fintech apps, they enable users to buy and sell stocks, and trade cryptocurrencies and commodities.

In order to develop a comprehensive investment and trading platform, a sophisticated backend architecture and secure APIs are needed, to receive and transmit live market data. The development cost of building such an app would be around $250,000 –$500,000+ based on requirements.

The number might seem astonishing to some, but on top of app design and development costs, there are costs associated with regulatory compliance with the SEC, FINRA, FCA and others. Additionally, modern apps are equipped with AI-powered risk mitigation features, intelligent algos, and portfolio automation which add up to all of this.

-

Buy Now, Pay Later (BNPL) Apps (e.g., Klarna, Afterpay, Affirm)

Buy Now, Pay Later, also known as BNPL, is a comparatively new phenomenon that is now picking up in the market. Lately, BNPL platforms have surged in popularity, allowing consumers the convenience of short-time financing and flexible payment plans.

If you are looking to build a full-blown BNPL fintech app, the cost of it would range from $170,000 to $450,000 – again, varying because tech stack, features, merchant integrations and APIs can have various underlying costs.

In this sort of fintech app project, a major portion of the budget goes to credit scoring models and underwriting systems which ensure that all decisions related to lending (what, when and how) are made efficiently.

-

Neobank and Challenger Bank Platforms (e.g., Chime, Revolut, N26)

Banks with physical branches are slowly phasing out, and that is where the concept of neobanks and challenger bank platforms emerges – offering an entirely digital banking experience to customers around the globe.

Compared to other apps in the sector, the cost of building a neobank fintech app is significantly more, mainly because of the complexity of the system, and core banking integrations as well as KYC/AML processes, enforced by the regulator.

These fintech applications typically range from $250,000 to anywhere around a million, heavily influenced by the need for partnerships with traditional financial institutions, regulatory approvals, end-to-end encryption, etc.

Also, the need for seamless integration with payment processors, cross-border transactions, and real-time, instant fund transfers adds to infrastructure costs.

-

Lending and Peer-to-Peer Loan Platforms (e.g., SoFi, LendingClub, Upstart)

Lending apps are the new way and digital way to connect borrowers and investors/financial institutions. These apps facilitate individual loans, emergency loans, as well as small business loans with competitive interest rates.

As per our experience of building fintech mobile apps, the estimated cost of development ranges from $250,000 – $600,000, depending on the level of automation and risk assessment features incorporated.

Here, the key cost center would be AI models that analyze the risk in lending to someone, automated repayment processing, intelligent underwriting models, and the compliance regulations.

If in design, a third-party credit scoring service provider can be linked within the app to make the overall process buttery smooth, targeting for better user experience and accuracy.

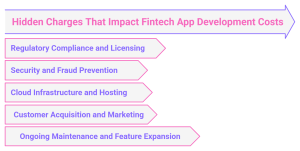

Hidden Charges That Impact Fintech App Development Costs

Once the development phase concludes, most fintech applications require continuous financial commitments in order to ensure 24/7 security, compliance and staying true to shifting marketing demands.

So if you are in the game for long, these incurred costs take a major chunk of your investment in the later stage of launch.

Regulatory Compliance and Licensing

Financial services operate in a highly regulated environment, making compliance one of the most significant cost factors. Licensing fees vary based on jurisdiction, with banking licenses costing between $200,000 and $500,000 in the United States, while state-specific money transmitter licenses (MTL) can exceed $1 million.

Additionally, ongoing regulatory audits, risk assessments, and reporting requirements require continuous investment. Neglecting compliance can lead to hefty fines and reputational damage, making proactive investment in legal advisory services essential.

Security and Fraud Prevention

Cybersecurity is non-negotiable in fintech applications, given the sensitivity of financial data. Implementing strong encryption protocols, fraud detection systems, and biometric authentication can add anywhere from $20,000 to $100,000 to development costs.

With the rise in financial cybercrime, AI-powered fraud detection models are becoming a necessity, increasing costs but reducing long-term risk exposure. Regular penetration testing, security audits, and compliance with international data protection laws (e.g., GDPR, CCPA) are additional cost considerations.

Cloud Infrastructure and Hosting

Fintech apps require high-availability cloud infrastructure to ensure 24/7 uptime and fast transaction processing. Cloud service costs vary based on user traffic and transaction volume, with expenses ranging from $5,000 to $50,000 annually.

Many fintech startups opt for scalable cloud solutions such as AWS, Google Cloud, or Microsoft Azure, balancing cost efficiency with performance. As user bases grow, infrastructure expenses increase, requiring strategic resource allocation.

Customer Acquisition and Marketing

A fintech app’s success depends on its ability to attract and retain users. Digital marketing campaigns, influencer partnerships, and performance-based advertising require an initial budget of $50,000 or more.

User retention strategies such as referral programs, cashback incentives, and loyalty rewards add to ongoing marketing expenses. A well-planned go-to-market strategy ensures faster adoption and long-term profitability.

Ongoing Maintenance and Feature Expansion

Fintech applications require continuous updates, security patches, and feature enhancements to stay competitive. Annual maintenance costs typically range between 15–25% of the initial development investment.

Market demands and user feedback drive future development, requiring additional budget allocations for new features, integrations, and compliance updates. Companies that invest in long-term scalability gain a competitive edge in the rapidly evolving fintech landscape.

Challenges in Fintech App Development and How to Overcome Them

Developing a fintech application comes with unique challenges. These challenges can significantly impact both the development process and the final product’s effectiveness. Below, we break down the most common challenges faced in fintech app development and how to overcome them.

1. Regulatory Compliance

Common Challenge: The financial industry is one of the most heavily regulated sectors, and fintech apps are no exception. From GDPR for data protection to anti-money laundering (AML) requirements and Know Your Customer (KYC) regulations, there are numerous compliance obligations that need to be met.

For startups or companies unfamiliar with the nuances of financial regulations, ensuring compliance with these laws can be both time-consuming and complex.

How to Overcome It: The key to overcoming regulatory hurdles is early consultation with legal and compliance experts who specialize in the fintech space. The incorporation of regulatory requirements into the design and development phases can minimize the risk of non-compliance.

Regular audits and continuous monitoring for any changes in laws and regulations will also help keep your application up-to-date and compliant. Moreover, building compliance into your development process with automated systems for KYC, AML, and data privacy can reduce both cost and time spent on compliance.

2. Data Security

Common Challenge: Security is perhaps the most critical challenge in fintech app development. The nature of fintech applications involves handling highly sensitive user data, including personal, financial, and transactional details. Any lapse in security can lead to data breaches, fraud, or hacking incidents that can tarnish the company’s reputation and result in legal consequences.

How to Overcome It: To address security concerns, fintech apps should prioritize implementing end-to-end encryption, two-factor authentication (2FA), and strong user authentication protocols. Employing strong encryption standards like AES-256 and TLS for secure data transmission is essential.

Regular penetration testing and security audits should be part of the development lifecycle to identify vulnerabilities early on. Also, ensuring compliance with global data protection regulations like GDPR and CCPA will add a layer of confidence in the app’s security standards.

3. Scalability and Infrastructure

Common Challenge: Scalability is a critical factor in fintech app development. As your user base grows, your app must be able to handle increased traffic, larger data sets, and a higher volume of transactions without compromising performance. Many fintech apps, especially those that process financial transactions in real time, face issues with scaling their infrastructure to meet these needs, which can lead to poor user experiences and system downtimes.

How to Overcome It: Start by building your app on a scalable cloud infrastructure like AWS, Google Cloud, or Microsoft Azure, which offers the flexibility to scale up or down based on demand. Microservices architecture and containerization (e.g., Docker) can help in efficiently scaling various components of the application.

Ensuring the app is modular will allow easier updates and changes in the future. In addition, stress-testing your app for high volumes of users and transactions, especially during peak usage times, will help identify performance bottlenecks early in the development process.

4. User Experience (UX) Design

Common Challenge: A fintech app’s success depends heavily on user experience. However, providing a seamless user interface while maintaining robust security and regulatory compliance can be a delicate balancing act. Poorly designed interfaces or difficult navigation can lead to frustration, increasing abandonment rates. In contrast, well-executed UX/UI design helps to engage users and ensure they are comfortable and confident in using the app.

How to Overcome It: Focus on developing a user-centered design by working with UX/UI experts from the beginning. It’s essential to map out user journeys and ensure a smooth, intuitive process for both new and experienced users.

Strive for simplicity while offering all the necessary functionalities, such as real-time transaction processing, balance checking, or loan applications. Testing the app across different devices and screen sizes ensures a consistent experience, and conducting usability tests throughout the development process will identify areas for improvement.

5. Integration with Third-Party Services

Common Challenge: Most fintech apps rely on third-party services for functionalities like payment processing, identity verification, credit scoring, or accessing financial data from banks. While these integrations are necessary for the app’s functionality, they can also introduce challenges, including compatibility issues, security risks, and additional costs. Managing and maintaining these integrations can become a complex task, especially as the app scales.

How to Overcome It: Carefully evaluate and choose reliable third-party service providers with a proven track record. Conduct in-depth research and ensure their APIs are well-documented and provide the functionality you need. It’s also essential to test the integrations extensively during development to identify any compatibility issues early on.

Using robust API management tools can help ensure smooth integration and provide real-time insights into third-party services. Additionally, ensure that your third-party services comply with the same security and data protection standards as your app.

6. Ongoing Maintenance and Updates

Common Challenge: Once the fintech app is live, the development process doesn’t end. Keeping the app up-to-date with new features, security patches, and regulatory changes is an ongoing challenge. Failing to maintain the app regularly can lead to outdated functionality, security vulnerabilities, and poor user experience.

How to Overcome It: Implementing an agile development process allows for continuous updates and improvements. Schedule regular maintenance to ensure the app is always aligned with the latest security protocols and compliance standards.

Establish a team for monitoring app performance, identifying bugs, and responding to user feedback in a timely manner. Automation tools can be used to monitor system health and flag any issues before they impact users.

7. Cost and Resource Management

Common Challenge: Fintech app development can be costly, especially when incorporating advanced technologies and ensuring regulatory compliance. Managing these costs while maintaining quality can be challenging, particularly for startups or smaller businesses with limited resources.

How to Overcome It: Prioritize essential features in the initial development phase and use a phased approach to build out the app incrementally. Focus on developing a Minimum Viable Product (MVP) to launch quickly and gather feedback from users.

This will allow you to allocate resources effectively and avoid spending on features that may not be necessary initially. Additionally, leverage cloud-based solutions to minimize infrastructure costs and maximize scalability.

Conclusion

The fintech app development services are evolving rapidly and staying informed about industry standards and benchmarks is more important than ever, especially when one is looking to invest. Creating a fintech app that can stand the test of time is no doubt difficult, but with dedication and conviction, there’s nothing impossible.

As the fintech market continues to grow, with projections indicating a market size of over $700 billion by 2030, the importance of effective budgeting and strategic planning cannot be overstated.

Thank you for reading our comprehensive guide on fintech app development cost. We invite you to reach out for a detailed consultation and to learn more about how our expertise can help you build a secure, innovative fintech solution tailored to your unique needs.

Start Your Fintech Journey

Ready to build your fintech app? Let’s turn your vision into reality with a tailored development plan.

Hire ExpertFAQs